1. Is the company undervalued?

EV/EBIT: 6.61

EV/Sales: 0.61

Price/Book: 1.63

$UA faces a number of challenges including; slowing demand, currency headwinds, and an open CEO role. With that said the business is throwing off significant free cash and has grown at an above market rate historically. Nonetheless Under Armour is working thru a large inventory pile up, so earnings will look ugly for at least another couple quarters. This opens up an opportunity for long term investors to buy a durable brand with solid growth prospects trading at a single digit earnings multiple.

2. Can I easily explain what the company does?

Yes, they sell mostly apparel and footwear under the Under Armour brand.

3. Does the cash flow statement line up with income statement?

Yes, cash from operations has been meaningfully higher than reported earnings:

Most of their excess cash went towards debt repayment, capital expenditures, a buildup of inventories, and share repurchases. Inventories are up ~9% YOY which is never a good sign, but that number is relatively strong compared to other apparel companies. Other than that, I have zero issues with the way management decided to allocate capital.

4. Is the Balance Sheet Healthy?

Total Debt: $1.46B

Total Cash: $1.05B

Current Ratio: 2.30

$UA has a pretty solid balance sheet with only ~$400M of net debt. Furthermore net interest payments last year totaled less than $45M. That works out to over 11.5X net interest coverage. Granted this based on solid year of trailing earnings, but still well covered even assuming a significant earnings decline.

5. How profitable is the business?

Gross Margins: 50.4%

Operating Margins: 9.2%

Net Margins: 6.3%

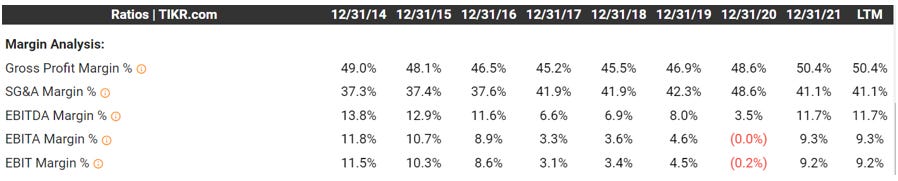

$UA is an established brand, which is able to charge a premium for their products. With that said the business is probably overearning and management is forecasting a more promotional environment near term. Candidly forecasting out a normalized margin profile for Under Armour is extremely difficult:

While gross margins have been fairly stable, operating margins have been all over the place. I’m not sure if 3% or 9% is an appropriate EBIT margin long term based on this data. The good news is that management has a lot of control over operating expenses. The bad news is that margins are almost certainly going to be down massively YOY in the next couple of earnings reports.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 14.5%

10-yr Operating Profit CAGR: 9.69%

10-yr FCF CAGR: 14.89%

Again the trailing numbers look fantastic, but should be taken with a grain of salt. For context $UA did a lot of acquisitions in the front end of that 10-year sample period. Furthermore, from 2017-2021 sales only grew at a 2.64% CAGR. In fairness I cherry picked the worst 5 five period in the sample, but nevertheless double-digit growth moving forward is probably too ambitious. Having said that I would expect $UA to grow at a market rate once they get thru this slow period.

7. Is management rewarding shareholders?

Under Armour currently has $175M left on their share repurchase program. The company also throws off tons of free cash flow, averaging ~$245M per year over the last 6 years. With $1B in cash and the stock down 66% YTD, one would think that now is the time to back up the truck regarding buybacks. However the CFO tempered expectations on their last earnings call:

“David Bergman (CFO)

Yes, Jay, this is Dave. Obviously, we continue to look at what the different options are that are out there. We're happy with where we are from a liquidity perspective and overall balance sheet perspective.

We do have some open remainder on the share repurchase program. So we will continue to pursue that prudently. And then we'll continue to look at other options as well. But at this point, we continue to believe that having the liquidity that we have is very helpful. It allows us to be nimble. It allows us to continue to look at new opportunities, whether they be organic or not. But at this point, we're in a good spot.”

I hate this response! My dude your stock is trading cheaper than it ever has, you have plenty of cash, and just bragged for 15 minutes about how wonderful and profitable your business is!?!?!?!? Frankly speaking I think the CFO is scared to look stupid repurchasing shares only to see the stock drop even further in the future. Also you can pound sand with the accretive M&A talk, especially considering that $UA has plenty of opportunities to re-invest back into their own business. These include; their DTC business, international markets, and leisure apparel. This is honestly a chicken shit answer and shows that the CFO is either incompetent or mis aligned with shareholders.

8. How does the company stack up against their peers?

Sketchers U.S.A Inc. $SKX is probably the closest competitor to $UA

$SKX EV/Sales: 0.88

EV/EBIT: 11.52

EBIT Margin: 7.7% (TTM)

$UA is much cheaper on a trailing basis, but both trade at a similar valuation compared to forward numbers. Moreover both companies have sound balance sheets and have grown at more less the same rate. There’s not a clear winner here, but I think $SKX has a much better management team, so I prefer them. I also did a writeup on $SKX back in April if you’re interested:

9. What’s the counter argument?

The counter argument is that demand is slowing while macro-economic headwinds are picking up. These include increased promotional activity, a strengthen US dollar, and higher freight costs.

I more or less buy into this thesis, with the exception of higher logistics costs. Freight costs are going down across the board and the backlog of ports is essentially gone. With that said these headwinds are all temporary in nature and nothing seems structurally wrong with the business. We’ll see how long this lasts, but shareholders will likely have to close their eyes and hold their nose for at least another 6 months.

10. Is there something I think the market may be missing?

I think the market is appropriately discounting a slowdown into today’s stock price. Although I’m not so sure Mr. Market is pricing in a rebound on the other side. If you’re of the mindset that $UA can grow at a market rate and maintain high single digit operating margins long term, then the stock is almost certainly mispriced today. Additionally if the slowdown is better than expected $UA shareholders could benefit from a sudden repricing.

Final Thoughts:

I usually walk thru an expected return here, but management is throwing off all the wrong vibes. I don’t care if the stock is a net-net, if I can’t trust you I certainly can’t give you any of my capital. Furthermore, I think there are far better names in the consumer discretionary category at this moment in time. Here are a couple other companies I wrote up previously this year:

(This aged horrendously, but credit to me for taking the L in public)

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice