1. Is the company undervalued?

EV/EBIT: 6.89

EV/Sales: 0.5

Price/Book: 2.4

$PLCE is trading at an attractive valuation, nearing decade lows in regards to sales and book value. With that said there’s serious growth concerns and the company is currently overearning compared to its history. On the other hand, children’s clothing is most likely less cyclical than your prototypical discretionary retailer. This coupled with a strong capital return policy makes $PLCE an idea worth looking into.

2. Can I easily explain what the company does?

Yes, they’re a specialty retailer focused on children’s clothing. $PLCE currently has 658 stores in operation with half their sales coming from brick and mortar and the other half coming from e-commerce.

3. Does the cash flow statement line up with income statement?

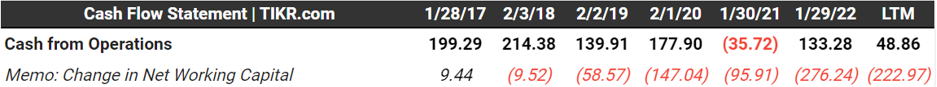

No, cashflows haven’t come close to lining up with reported earnings:

Most of this can be explained by a change in working capital, chiefly an increase in inventories and an outflow of accounts payable. While this is a re-occurring theme amongst retailers presently, it’s only been a recent phenomenon:

Shockingly $PLCE has seen an outflow of working capital every year for the past 5+ years. Moreover revenues have actually declined since 2017, which leads me to believe that there’s some financial chicanery going on! Best case scenario this reflects an incompetent management team and worse case is outright fraud.

Regarding capital allocation management spent most of their cash on share repurchases, a build up of inventories, an outflow of accounts payable, and capital expenditures. Most of the buybacks were done well off the highs and their inventory situation has improved from Q2, so I don’t have any issues with these decisions.

4. Is the Balance Sheet Healthy?

Total Debt: $373M (this excludes operating leases)

Total Cash: $19M

Current Ratio: 0.97

$PLCE does hold some debt relative to their market cap, but not an unhealthy amount IMO. Interest expenses over the last 12 months totaled less than $14M, which works out to over 9X net interest coverage. Even if earnings were to get cut in half the company would still be well covered and for that reason $PLCE gets a passing balance sheet grade.

5. How profitable is the business?

Gross Margins: 35.7%

Operating Margins: 7.3%

Net Margins: 5%

As mentioned previously $PLCE is overearning compared to its history:

However these metrics are only modestly above trend and $PLCE has posted exceptional ROIC metrics over the past decade. Conversely the macro environment is not accommodating for retailers at the moment and $PLCE is guiding to end 2022 with a ~4.7% operating margin. Notwithstanding I would assume margins bounce back in 2023 as input and logistics costs are starting to come down.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 1.1%

10-yr Operating Profit CAGR: 10.4%

10-yr FCF CAGR: (1)%

Again we see cashflows not lining up with reported income. In fairness the end date used (2021) was an exceptionally good year for $PLCE, so that growth is certainly overstated. Nevertheless the fact remains $PLCE is struggling to generate meaningful cashflow.

Moreover $PLCE has shifted their business model, focusing on digital with 50% of sales now coming from e-commerce. That in and of itself is not a cause for concern, but $PLCE is in the process of shrinking their store count. They plan on eliminating between 40-50 stores next year. This implies a nearly 7% reduction in store count at the mid-point. It’s likely that e-commerce continues to grow, but I doubt it grows fast enough to make up for this delta. In summation I wouldn’t expect any growth moving forward and if anything would anticipate sales to decline.

7. Is management rewarding shareholders?

$PLCE doesn’t offer a dividend, but have repurchased shares every year for the past 10 years and bought back nearly $84M in the last 12 months. Unfortunately management is dipping into their cash cushion to fund these buy backs. For example, FCF averaged $56.7M over the last 4 years while they’ve simultaneously bought back ~$121M on average over that same period. Furthermore stock based comp has also averaged over $22M per year in the last four years. Being that there’s no more cash to pull from I wouldn’t expect any higher than a $30M net shareholder yield moving forward. This works out to a touch under a 6% net yield, which is fairly underwhelming for a no growth company.

This also leads me to the debate regarding share repurchases for a shrinking company. I actually don’t mind if a melting ice cube is buying back shares, so long as the business is obviously trading below intrinsic value. I’m not so sure that’s the case here however and would prefer if $PLCE paid out dividends instead (preferably special dividends).

8. How does the company stack up against their peers?

Carter’s $CRI is closest competitor to $PLCE:

$CRI EV/Sales: 1.16

EV/EBIT: 9.46

Operating Margins: 12.3%

$CRI is more expensive that $PLCE, but it’s objectively a much better business. They’re overearning by a lower margin, have historically grown faster, and have better ROIC metrics. The management team is also much less sketchy and for that reason $CRI seems like the better buy. I also did a write-up on $CRI a while back if you’re interested:

9. What’s the counter argument?

The counter argument is that consumers will continue to pull back on discretionary spending as they’re still battling inflation.

I don’t disagree with this, but I don’t think the spending pull back will be as severe as feared. Inflation is starting to come down and the unemployment rate remains extremely healthy. This coupled with lower inputs costs such as cotton, makes me think $PLCE should be able to recovery back to their normal margin profile.

10. Is there something I think the market may be missing?

Yes, I have serious doubts that consumers will pull back meaningfully on expenses for their children. Chiefly because new parents have an obsession with posting baby pics on Instagram (Obvi they can’t have the same fit twice). Furthermore small children need a wardrobe update more frequently than their adult contemporaries. For instance I’ve worn the same pair of jeans for the past 3 years, whereas a 4 year old will need new clothes every year.

Final Thoughts:

I’m not gonna lie I hate this management team for multiple reasons. First and foremost their financials make zero sense to me. Additionally their latest earnings call was one most bizarre calls I’ve ever listened to. They started the call by highlighting their ESG accomplishments. I honestly don’t care if a company wants to make the world a better place, but that should come only after taking care of your shareholders first. Frankly speaking no one gives a shit about how much you’ve reduced your green house gas emissions by. Additionally their marketing team is taking a victory lap for paying Mandy Moore and the Kardashian’s to be their brand ambassadors;

“Maegan Markee (SVP Marketing)

Success is defined by follower engagement and due to our overwhelming response of our celebrity marketing campaigns during the third quarter, our social audience of over 2 million followers on Facebook and over 1 million followers on Instagram, drove the highest number of engagements of any Children's brand in our industry.”

Hate to break it to you Maegan (the name alone is a red flag), but impressions and an increased follower count has literally nothing to do with profitability. I don’t want to be overly harsh here but sales and operating profits are down 9% and 49% respectively YOY. Those numbers suck and the C-suite is acting like they’re tearing the cover off the ball:

“Jane Elfers (CEO)

Thanks, Maegan. As you can clearly tell by listening to Maegan, we are very excited about the results we are achieving through our increased and targeted marketing efforts. And we're even more excited about how we can leverage these learnings to drive results in 2023 and beyond. We're also very pleased with our continued strong results from our Amazon partnership.”

The culmination of all these things makes $PLCE uninvestable for me, put simply the vibes are way off.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice