1. Is the company undervalued?

EV/EBIT: 12.34

EV/Sales: 3.41

$SIX is a high-quality business, which is growing slowly and trading at an attractive price. On the other hand, $SIX is heavily indebted and in the process of changing their business model. Nevertheless, amusement parks have been around for literally hundreds of years and extremely unlikely to be disrupted. If management can figure out the right mix of attendance levels and admission pricing, investors could be handsomely rewarded for buying while there’s still uncertainty.

2. Can I easily explain what the company does?

Yes, they operate 27 amusement parks in North America.

3. Does the cash flow statement line up with income statement?

Yes, cashflows have been consistently higher than reported earnings:

Most of their excess cash went towards debt repayment, capital expenditures, and share repurchases. It could be argued that $SIX should’ve repaid more debt instead of buying back shares, but I have a big-time bias towards shareholder yield and the repurchases were done at a fairly low valuation IMO. Honestly I probably wouldn’t have changed a thing if I were CFO regarding capital allocation.

4. Is the Balance Sheet Healthy?

Total Debt: $2.47B

Total Cash: $74.8M

Current Ratio: 0.41

Being less than a $2.2B company, there’s no doubt $SIX has a balance sheet problem. Moreover the company has a 2.81X net interest coverage ratio, which is frankly abysmal. Furthermore interest rates are skyrocketing and most of their debt will have to be rolled, which further exacerbates balance concerns. Be that as it may earnings are expected to grow from here, so if all goes well debt levels should be more than manageable in couple of years.

5. How profitable is the business?

Gross Margin: 49.4%

Operating Margin: 27.7%

Net Margin: 8.8%

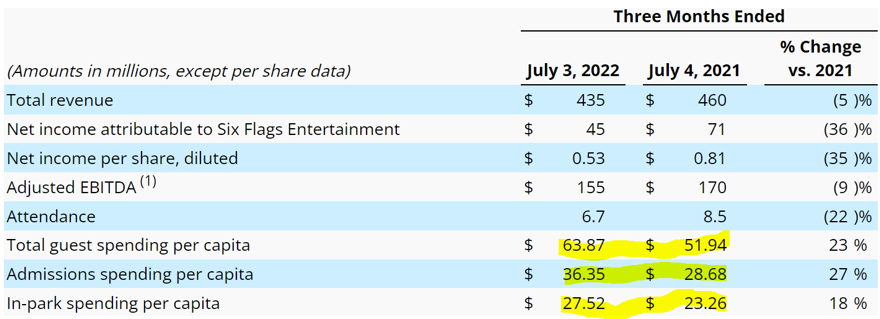

As you can see $SIX is a highly profitable business and interestingly the company is most likely underearning. They’ve recently pivoted their business model from trying to get as many people into their parks as possible, to going after fewer high-quality consumers who are spending more. These strategic moves are already flowing thru the financial statements:

The drawback here is that revenues and earnings are down YOY. However compared to 2019 (on an adjusted basis) EBITDA is up 5% with attendance levels down 37%. If $SIX can keep growing earnings, I couldn’t care less what happens with the topline. Additionally I’m a huge fan of this strategy as guests will no doubt have a better experience with shorter wait times. All in all I would expect margins to expand in the future, as $SIX is still comping against the old model for a couple more quarters.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 4%

10-yr Operating Profit CAGR: 7.02%

10-yr FCF CAGR: (1.71%)

$SIX is a slow growth company, but it is growing nonetheless. The CEO also made it a point on the last earnings call to highlight his goal of hitting $710M in EBITDA within 3 years. That works out to a ~10% CAGR assuming it takes the full 3 years. This goal is a bit ambitious, but not unrealistic as the company has a few levers to pull in order to hit it. For example park admissions at $SIX are relatively cheap vs. competitors, so it's likely they can keep raising prices. Moreover earnings could grow simply by eliminating money losing programs such as their dining pass.

7. Is management rewarding shareholders?

$SIX does not offer a dividend, but have ~$135M remaining on their current share repurchase program. However $SIX is paying $150M annually in interest payments and $140M on capital expenditures. Six Flags is also only expected to post $432M in EBIT over the next 12 months, which leaves virtually no meat on the bone for shareholders. Factoring in stock based compensation and future debt repayment, investors would be fortunate to receive $75M on net back in cash. That’s not too shabby tho, as it works out to a little less than a 3.5% shareholder yield. Nevertheless there’s a good chance management does a 180 and decides to exclusively pay down debt over the next 18 months or so.

8. How does the company stack up against their peers?

Cedar Fair $FUN is Six Flag’s biggest competitor:

$FUN EV/Sales: 2.88

EV/EBIT: 15.54

Operating Margin: 18.5%

$FUN is cheaper relative to sales, but more expensive on basically every other metric. The company is also less profitable and has grown at a slightly lower rate. Additionally both business are riddled with debt and sport similar financial health metrics. I will say $FUN has executed better near term and there’s much less uncertainly surrounding their business. But scared money don’t make no money and $SIX is a much more asymmetric bet IMO.

9. What’s the counter argument?

The counter argument is that the new model won’t work and $SIX will continue to see declines in both revenues and earnings. Additionally to a lesser extent inflation/recessionary pressures will cause a slow down for the business.

I’m not too concerned about macro for $SIX as it’s an incredibly durable business. Sure 2022 may see a downtick, but the company will no doubt have feast years if you hold the stock for long enough. Regarding the new model, I think it makes all the sense in the world both from a consumer and shareholder standpoint. Being shoulder to shoulder with strangers all day sucks and I’m all for paying extra in order to keep the trash out. Furthermore lower attendance will likely mean less employees needed and therefore lower SG&A expenses.

10. Is there something I think the market may be missing?

$SIX is making a concerted effort to decentralize their organization. On their last earnings call the CEO made the following comments to that point:

“Last year, our costs grew faster than our revenue, especially in our corporate office. We now view corporate's role as that of a support center for our parks, and we have delegated activities to our parks. We have also continued to optimize our full-time and seasonal labor in the parks. As a result, we have reduced our full-time headcount by almost 25% since the beginning of the year.”

Henry Singleton the CEO of Teledyne took this concept to an extreme by employing over 40K people, while headquarters sat less than 50. Teledyne has been over a 180 bagger since inception, so perhaps there’s something to be said about the power of decentralization. As a side note I would highly recommend reading The Outsiders by William Thorndike and listening to his podcast 50X (literally catnip for capital allocators).

Final Thoughts:

My base case for $SIX would be as follows; EBIT growing at 7% per year with a 3% net shareholder yield annually. I would also forecast out a 17X EV/EBIT exit multiple 5 years from now. That works out to a ~16.5% expected return, which is lowballed as I’m not adding back cash used for debt repayment. Candidly $SIX is a company I would love to own from a qualitative standpoint, it’s extremely Lindy and there’s next to no competition. For these reasons I’m strongly considering starting a position. However I would like one more quarter of data regarding their new business model. If management can execute on what they’re saying and the stock remains cheap, I will likely become a shareholder.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice