PVH Corp. $PVH

My Investment Checklist

1. Is the company undervalued?

EV/EBIT: 7.84

EV/Sales: 0.73

Price/Book: 0.7

$PVH is trading at its lowest valuation since the great financial crisis. The company also sports solid long term growth prospects, while throwing off significant free cash flow. On the other hand it could be argued the business is over earning and will see a meaningful contraction in profitability as macro concerns hit discretionary stocks the hardest. Nevertheless $PVH is compelling because it gives long term investors an opportunity to benefit from multiple expansion and earnings growth, while the company returns meaningful capital back to shareholders in the interim.

2. Can I easily explain what the company does?

Yes, they are an international apparel company. Their two brands are Tommy Hilfiger, which make up ~54% of sales and Calvin Klein which make up ~45% of sales.

3. Does the cash flow statement line up with income statement?

Yes, cashflows have been on net higher than reported earnings:

Most of their excess cash went towards; debt repayment, share repurchases, capital expenditures, and the buildup of inventories. Inventories are up 19% YOY, which in absolute terms is not good. However in context $PVH’s inventory situation is actually a lot better compared to other apparel companies (Looking at you $LEVI up 29% YOY and $HBI up 37% YOY). Other than that I don’t have any issues with management’s capital allocation decisions.

4. Is the Balance Sheet Healthy?

Total Cash: $699M

Total Debt: $2.15B

Current Ratio: 1.35

At first glance it looks like $PVH holds a nice chunk of debt, although over $1.1B is coming from operating leases. In fact interest expenses in 2022 are only expected to be $85M, which gives $PVH a nearly 10X net interest coverage ratio. For these reasons, $PVH has a well above average balance sheet.

5. How profitable is the business?

Gross Margins: 57.9%

Operating Margins: 9.4%

Net Margins: 10.2%

$PVH has an impressive margin profile, although there’s some skepticism as to whether these margins are sustainable:

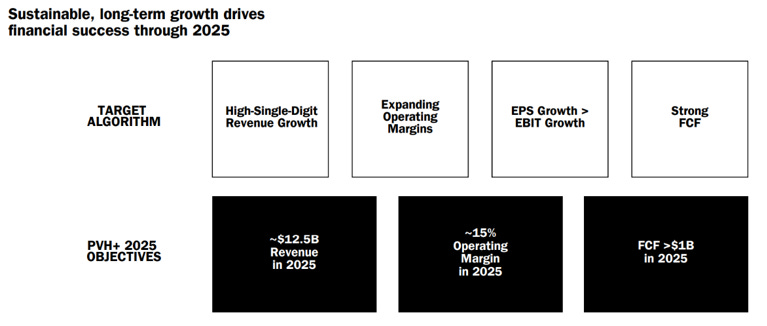

Candidly thinking thru a normalized margin for $PVH is probably the most important determinate for prospective investors. On one hand they’re objectively over earning compared to historical metrics. On the other hand management recently gave the following as their long term goal:

I honestly don’t understand how management plans to hit 15% EBIT margins by 2025. They plan on reducing headcount by 10%, are implementing cost cutting measures, and supply chain expenses are finally starting to ease. However they’re also leaning into their direct to consumer business, which almost surely is less profitable than traditional brick and mortar.

Personally I don’t feel confident projecting out any higher than a 9% EBIT margin long term. If you eliminate 2021 (Covid year), $PVH has averaged a ~8.5% EBIT margin over the last decade. So I think there will be some incremental improvement, but remain cynical about management’s lofty expectations.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 4.5%

10-yr Operating Profit CAGR: 2.88%

10-yr FCF CAGR: 8.69%

These numbers don’t look great, however the start date used (2013) was an exceptionally good year for $PVH with a 10.8% operating margin. Moreover $PVH still hasn’t got back to their 2020 revenue numbers. Therefore it wouldn’t surprise if topline grew faster than their bottom line for the next couple of years. Moreover Calvin Klein and Tommy Hilfiger are extremely durable brands and I would be stunned if either turned into an Abercrombie & Fitch situation. With that said $PVH is not going to be a compounder, but mid-single digit growth should be enough to keep the multiple contraction away.

7. Is management rewarding shareholders?

$PVH offers investors a 0.27% dividend and have a $3B share repurchase program in place. With a $3.6B market cap, it doesn’t take a genius to figure out that management can drive massive shareholder value with buybacks at these levels. Furthermore $PVH has averaged ~$605M in FCF over the last 4 years and have repurchased shares every year for the last 10 years! Given the buildup on inventories $600M in FCF seems like a conservative estimate over the next 12 months. Additionally $PVH has a significantly improved balance sheet and $400M on net returned back to shareholders seems reasonable, which works out to a breathtaking ~11% shareholder yield!

8. How does the company stack up against their peers?

Ralph Lauren $RL is probably the closest competitor to $PVH

$RL EV/Sales: 1.13

EV/EBIT: 9.14

Operating Margins: 12.3%

$RL is more expensive across the board, but has a better balance sheet and profitability metrics. Conversely $RL has been a no growth company for some time and $PVH is throwing off more free cashflow with a 40% lower market cap. This one seems like a no brainer in favor of $PVH.

9. What’s the counter argument?

The counter argument is that a global slowdown will cause revenues and profits to decline for an indefinite amount of time. Furthermore $PVH is more exposed internationally and all the macro big brains are predicting a nuclear winter for Europe as natural gas prices have skyrocketed.

You’d be hard pressed to argue that the global economy isn’t headed for a downturn. Naturally consumers will be less likely to buy a fresh new Calvin Klein fit if they can’t afford to heat their homes. Howeva and this is going to trigger some macro know-it-alls, but macro means nothing if you plan on holding a decent quality stock for more than 9 months. I can assure 5 years from now, no one is going to be talking about record high inflation or the war in Ukraine. Additionally Mr. Market is going to price in a recovery long before it comes thru in the economic data. Need I remind you of March 2020??? Literally no perma bear flipped bullish at that time!

10. Is there something I think the market may be missing?

I don’t think the market is missing anything per se, but consumer discretionary and retail have gotten absolutely annihilated in 2022. For instance $XRT and $XLY are down ~31% and 24% YTD respectively (thank god I’ve been overweight). I think some stocks in those industries probably deserve to be down more, but everything seems to be moving in lockstep regardless of individual performance. In this instance, I think $PVH is the proverbial baby being throw out with the bath water. For example revenues are expected to increase 3% in 2022 on constant currency basis. I have no clue what’s going to happen with the Dollar/Euro exchange rate, but I do know if investors wait long enough this headwind will eventually become a tailwind.

Final Thoughts:

My base case would be as follows revenues growing 5% annually with a 9% EBIT margin 5 years from now. I would also anticipate a 11% net shareholder yield per year and a 14X EV/EBIT exit multiple at the end of year 5. That works out to an otherworldly ~28% IRR! I would also like to point out the fact that I’m not deviating much from historical growth, profitability, and valuation metrics (also not adding back any cash for debt repayment). I didn’t think walking into this write-up that $PVH would be so compelling, but I can’t see a scenario were this stock doesn’t delivery market beating returns over the next 3-5 years. For this reason I will almost certainly start a position in the stock during my next buy cycle. And finally please DO NOT buy $PVH based on my analysis, as I have been wrong more times than I care to admit.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice