1. Is the company undervalued?

EV/EBIT: 22.8

EV/Sales: 1.75

$PZZA is most likely not gonna show up on any best ideas list for either a value or growth manager. With that said Papa John’s is a proven franchise model with ample white space to grow. Moreover the business is probably underearning and could see margin expansion moving forward. This coupled with a decent shareholder yield and solid balance sheet, makes $PZZA an idea worth looking into.

2. Can I easily explain what the company does?

Yes, they sell pizza. Papa John’s currently has 5,589 restaurants in operation across 47 countries, ~91% of which are franchised and ~9% are company owned.

3. Does the cash flow statement line up with income statement?

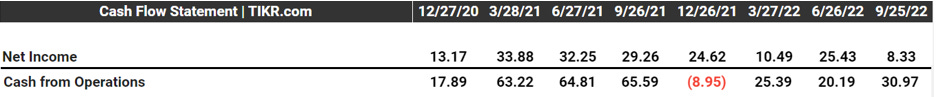

Yes, cash from operations has been consistently higher than reported earnings:

Most of their excess cash went towards share repurchases, capital expenditures, dividends paid out, and various one-off expenses. Non-reoccurring expenses should always be examined closely as I’ve found they tend to reoccur with bad management teams. However in this instance most of these costs are coming from store closures as a result of the Ukrainian war and the re-franchising of 90 restaurants. Additionally $PZZA hasn’t historically taken many one off charges, so I’m willing to give management the benefit of the doubt here.

Regarding capital allocation $PZZA spent ~$135M on buybacks from 9/26/21-6/26/22. For context $PZZA was trading at over 30X EV/EBIT for the majority of that 9-month sample period. Conversely the stock was trading at a low 20’s multiple last quarter and management only wanted to repurchase $21M worth of stock. Suffice to say there doesn’t seem to be much price discipline regarding Papa John’s capital return policy. This is a big-time unforced error that has objectively destroyed shareholder value.

4. Is the Balance Sheet Healthy?

Total Debt: $750M

Total Cash: $36.6M

Current Ratio: 0.91

$PZZA holds some debt, but not an egregious amount. Interest payments last year totaled ~$26M, which gives them an over 6X net interest coverage ratio. That’s well above average and for that reason $PZZA gets a good, but not great balance sheet grade.

5. How profitable is the business?

Gross Margins: 30.2%

Operating Margins: 7.7% (adjusted)

Net Margins: 3.3%

Papa John’s is not the most profitable business, but have excellent ROIC metrics due to their franchise model:

I would actually argue that $PZZA is an above average business, because of their reinvestment runway. Additionally the average 10-yr EBIT margin is most likely understated, as $PZZA had a tough stretch from 2018-2020. For example operating margins were consistently higher and more stable in the preceding 9 years:

The business no doubt faces some near-term cost pressures, but I don’t think it would be unreasonable to assume a 7.5-8% normalized EBIT margin moving forward.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 5.4%

10-yr Operating Profit CAGR: 6.11%

10-yr FCF CAGR: 6.64%

These numbers look solid, but should be taken with a grain of salt as the end date used here (2021) was an above average year for $PZZA. Notwithstanding management believes they can open up between 1,400- 1,800 new locations by the end of 2025. That implies a ~8% CAGR in store count at the midpoint guidance. I’m a bit skeptical this happens, but even if management falls short the growth should still be satisfactory. Furthermore this doesn’t seem like a pie in the sky projection, as the business model is proven and their closest competitor Domino’s has ~19K locations in operation today. Throw in 1-2% annually from same store sales and double-digit growth is not out of the question.

7. Is management rewarding shareholders?

$PZZA currently offers investors a 2% dividend and have $329M authorized on their current share repurchase program. The company also generates significant FCF, posting a 9.2% FCF margin over the last decade. Being conservative I would expect $120M in FCF on average over the next few years, and $100M on net returned back to shareholders. That works out to just under a 3.5% net shareholder yield, which isn’t bad if the business can grow high single digits.

Additionally $PZZA is trading around their long average earnings multiple, so I don’t think it really matters whether management decides pay out a higher dividend or accelerate the pace of buybacks.

8. How does the company stack up against their peers?

Domino’s Pizza $DPZ is Papa John’s biggest competitor:

$DPZ EV/Sales: 4.24

EV/EBIT: 25.67

Operating Margins: 16.53% (TTM)

$DPZ is more expensive than $PZZA, but is more profitable and have grown at nearly twice the rate. Conversely $DPZ has much more debt and a propensity to buyback their shares at nosebleed valuations. There’s not a clear winner here, as $DPZ is likely underearning more so than $PZZA. However, I prefer $PZZA as they have much better growth opportunities and a lower bar to clear for margin expansion.

9. What’s the counter argument?

Macro-economic concerns along with slower than expected store openings are the biggest counter arguments for $PZZA.

I would concede that it’s unlikely management hits their restaurant opening goal by 2025. However I don’t think they’ll miss their target by a wide mark. On the other hand, inflationary pressures are no doubt having an impact. For instance, food costs were up 18% YOY in the last quarter. Although I don’t think this lasts long, as some of these expenses are starting to come down. $PZZA still managed a 7.7% operating margin(adjusted) is this tough environment, so it wouldn’t be unreasonable to forecast out a higher margin profile once the storm passes.

10. Is there something I think the market may be missing?

In Michael Mauboussin’s book “Expectations Investing” he highlights the increase of intangible assets in today’s modern companies ie; elevated R&D expenses. He uses Domino’s technology spend as an example. In short, the data gathered allowed $DPZ to build more profitable stores in desirable locations and target their marketing towards specific customers. While late to the game $PZZA is more or less copy catting this strategy:

“Rob Lynch (CEO)

Our continued investment in our proprietary technology stack is evident in our digital innovation, including personalized consumer communications made possible through enhancements to our marketing tech, data analytics and e-CRM capabilities. Our integrated partnership with third-party aggregators and our loyalty program, Papa Rewards, which has grown to more than 26 million members today, doubling the membership over the past few years. We believe these investments will unlock long-term growth opportunities across our entire system.”

This could result in a structurally improved margin profile, which is something I don’t think Mr. Market is discounting presently. I’d also recommend reading the book.

Final Thoughts:

My base case would be as follows 7% EBIT growth annually with a 3.5% net shareholder yield per year for 5 years. I would also expect an 18X EV/EBIT exit multiple at the end of year 5, which unfortunately only works out to a ~6% expected CAGR. It should go without saying that this doesn’t clear my hurdle rate. Although it’s a high-quality business that I would definitely revisit if the stock was trading at a low teens multiple.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice