1. Is the company undervalued?

EV/EBIT: 7.34

EV/Sales: 0.58

Price/Book: 2.53

*Please note long term operating leases are being excluded in the calculation of Enterprise Value here*

$HIBB is trading around the same valuation as many of its retail contemporaries. However the business is by no means a melting ice cube, with stores in only 36 states and plenty of room to expand. Additionally $HIBB is underearning relative to what management is guiding for, which makes the single digit earnings multiple a bit of a headscratcher. However $HIBB is challenged with macro-economic concerns and there’s reason to believe that the business will deteriorate meaningfully. With that said the stock is cheap, growing its earnings power, and returning capital back to shareholders.

2. Can I easily explain what the company does?

Yes, they’re a sporting goods retailer. $HIBB currently has 1,126 stores in operation, a majority of which are Hibbett sports stores and ~16% are City Gear stores.

3. Does the cash flow statement line up with income statement?

No, reported earnings have been higher than cash from operations:

Unsurprisingly this is being driven by a change in working capital, chiefly in inventory bloat. For example $HIIB had an inventory outflow of ~$145M in the first two quarters of 2022. In fact inventories are up a mind blowing ~56% YOY, which is never a good sign. Although it’s important to note that inventories were artificially low in 2021. For example, unit inventory levels are only up 2% compared to 2019. That’s still not great, but goes to show you how noisy YOY numbers can be. When in doubt zoom out!!!

Regarding capital allocation management spent most of their cash on capital expenditures, a build up of inventories, and share repurchases. I don’t hate these decisions but most of the buybacks were done near peak valuations and management tapered off the pace of buybacks as the stock price has declined, which is a ding against them.

4. Is the Balance Sheet Healthy?

Total Cash: $25.1M

Total Debt: $105.1M (This excludes long term operating leases)

Current Ratio: 1.31

$HIBB doesn’t hold much debt relative to their market cap and paid just over $1M last year in interest payments. The company did take on some debt recently, but its ridiculously well covered with $130M in trailing operating income. For these reasons $HIBB falls just short of being awarded a fortress balance sheet.

5. How profitable is the business?

Gross Margins: 35.2%

Operating Margins: 8%

Net Margins: 6.6%

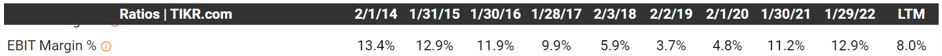

Retail is a tough industry and unsurprisingly $HIBB has below average profitability as a result. Although relatively speaking Hibbett has posted solid metrics historically:

However my issue with $HIBB is that profit margins have been all over the place:

Looking at this data, I have no clue what to use for a normalized earnings margin. To further confuse me management is guiding to end the year with a double digit operating margin. When asked how the SVP gave the following answer;

“William Quinn (SVP)

Alex, it's Bill. So the first part of that is we've asked our customers and they do anticipate spending more during this holiday season. The biggest category that's going to get that gain is footwear. On top of that, as I stated, we're in a record position as far as our member base and we've got a ton of active members, also record position as far as our ability to communicate with customers in terms of e-mail, text, push, social media, et cetera. So we're in great condition, great shape there. On top of that, we're seeing good sell-throughs, in particular in high-yield product.”

I simply don’t see how this happens especially with sneaker manufactures like Nike and Under Armour reporting low single digit revenue growth in their most recent quarters. It seems like management is putting too much faith in customer surveys, because it’s telling them what they want to hear. I could be proven wrong, but this statement screams over promise and under delivery.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 8.7%

10-yr Operating Profit CAGR: 6.99%

10-yr FCF CAGR: 3.19%

$HIBB has posted satisfactory grow, although I would prefer to see earnings growth outpace the top line. Nevertheless Hibbett has plenty of white space to grow and they’re in line to open up 40 net new stores this year. If $HIBB can continue at this pace the company will grow its store count by a 3.5% CAGR annually. Additionally $HIBB should see some organic growth in their e-commerce and same store sales. All in all I think mid-single digit growth is probably a good base case to have here.

7. Is management rewarding shareholders?

$HIBB offers investors a 1.5% dividend and have repurchased shares every year going back to 2011. Additionally FCF has averaged ~$95M per year over the last six years with minimal stock based compensation awarded. I don’t think it would be unreasonable to assume $95M on net being returned back to shareholders moving forward, which works out to north of an 11% net yield. That’s quite attractive for a company that’s still growing, but also assumes resilient profitability moving forward.

8. How does the company stack up against their peers?

The closest competitor to $HIBB is probably Dicks Sporting Goods $DKS:

$DKS EV/Sales: 1.05

EV/EBIT: 7.79

Operating Margins: 13.4%

This is not a true apples to apples comparison, as $HIBB is intentionally targeting smaller markets. With that said I believe $DKS is massively over earing and probably too expensive for that reason. Additionally I have a bias against Dick’s management team, so I think $HIBB is the better buy. I also did a write-up on $DKS earlier this year if your curious:

9. What’s the counter argument?

The counter argument is that $HIBB won’t be able to sell thru their merchandise and inflationary costs will eat into their profit margins.

I 100% buy into this thesis, $HIBB product mix is ~62% footwear. Management seems to be putting all their eggs into the sneaker basket, which I could see severely back firing. For example footwear manufactures had a massive pull forward in demand during the last two years. It’s not hard to envision an environment where demand decelerates meaningfully and forces $HIBB to get overly promotional as a result. If this occurs the valuation probably makes sense here.

10. Is there something I think the market may be missing?

Yes, Hibbett has a unique business model focusing on smaller population communities. This will allow them to expand without getting much attention from national chains like $DKS. For this reason $HIBB has much less competition than a traditional retailer and I could imagine a scenario where Mr. Market applies a premium relative multiple.

Final Thoughts:

I typically walk thru an expected return here, but I’m struggling to assign a range of outcomes for Hibbett’s margin profile moving forward. I could see them posting as low as a 4% operating margin two years from now or something as high as 13%. That’s a huge delta, which impacts any intrinsic value calculation immensely. Moreover management doesn’t seem to grasp capital allocation and are probably overpromising shareholders IMO. I don’t think there’s any nefarious intent here tho, as I’ve witnessed far sketchy behavior. However it’s a pass for me, but something to monitor as I’m a sucker for shareholder yield.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice