1. Is the company undervalued?

EV/Sales: 0.48

EV/EBIT: 4.17

Price/Book: 1.76

*Please note I’m backing out operating leases and customer deposits in the calculation of Enterprise value here*

$HVT is a cyclical stock that’s inexplicably performing well in this environment, with sales up 5.4% YOY and margins expanding in the latest quarter. Having said that the company is expecting a slowdown next year in both sales and earnings. Nevertheless the stock is trading at bargain basement prices with effectively zero solvency concerns. Furthermore $HVT has ample runway left to keep opening new stores while maintaining a shareholder friendly capital return policy. To quote Monish Prabrai $HVT seems like a “Heads I win, tails I don’t lose much” thesis.

2. Can I easily explain what the company does?

Yes, they manufacture and sell furniture. $HVT currently has 121 stores located primarily in the south eastern part of the US.

3. Does the cash flow statement line up with income statement?

No, reported income has been slightly higher than operating cashflow:

This however can easily be explained by a $70M change in working capital over the last 12 months. The primary driver of this is a decrease in customer deposits and an increase in inventories. Customer deposits are down ~33%, while inventories are up ~15% YOY. This is clearly suboptimal from a demand standpoint, but not unusual for a furniture company.

Other than that $HVT spent most of their cash on share repurchases, dividends paid out and capital expenditures. I have literally zero qualms with these capital allocation decisions from management.

4. Is the Balance Sheet Healthy?

Total Cash: $137.2M

Total Debt: $132.79M

Current Ratio: 1.61

As noted previously I’m backing out operating leases and customer deposits from the total debt calculation. With that said the company is sitting on a net cash position and therefore gets awarded a fortress balance sheet!!!

5. How profitable is the business?

Gross Margins: 57.6%

Operating Margins: 11.5%

Net Margins: 8.7%

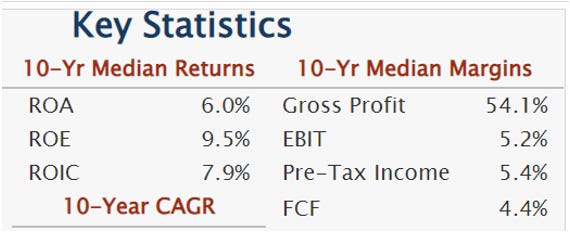

At first glance $HVT looks like a solid business, however the trailing data is likely showing peak earnings. Here’s a look at what they’ve done historically:

As you can see profitability could get cut and half and still be above the long-term trend. This is probably why the company is trading at an optically low multiple. With that said $HVT does have some tailwinds behind from an operational standpoint. Logistics costs are coming down, leads times are shortening, and $HVT plans on opening smaller lower cost stores moving forward. Nonetheless it would be a fool’s errand to extrapolate the near-term performance out into the future.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 5%

10-yr Operating Profit CAGR: 17.76%

10-yr FCF CAGR: 8.84%

Again the trailing data is painting an overly optimistic picture for $HVT. Although these results are no doubt impressive and have been done 100% organically. In fact, management believes the company can continue opening stores for the foreseeable future:

“Clarence Smith (CEO)

Well, we do have a goal of 5 stores a year for next year. We have struggled with getting stores open because of supply chain issues, getting product for the stores, not inventory but just to build the facilities out. And that's still going to be a challenge. I see there are going to be opportunities for us, but we recognize there's a challenge. I think there are going to be some very good positions in our existing footprint that we're going to be able to move into.

And we're looking at every market aggressively for second stores, if necessary, some new markets. We think there are going to be opportunities for us to grow with a footprint and a size that is a little bit smaller than we have done in the past. We're looking at store sizes in the 25,000 square feet range, even smaller in some cases, but 25,000 or 30,000 square feet, where our average is 35,000 square feet and many we have in the 50,000 square foot. So we think there are opportunities. We do have a goal of 5 stores a year. In some markets, it's a challenge to find those locations.”

With only 121 stores in operation today, that would imply a ~4% increase YOY assuming they open 5 locations in 2023. Although sales growth will probably be slightly lower if the stores opened are smaller in footprint. Nevertheless low-mid single revenue growth is probably the most likely outcome once demand fully normalizes.

7. Is management rewarding shareholders?

$HVT currently offers investors a 3.6% dividend and have $20M authorized to buyback shares. Moreover $HVT has been extremely shareholder friendly historically, paying out a dividend every year since 1935 and increasing it every year since 2013. With that said the business is quite cyclical and for that reason it’s hard to predict what FCF will be. Over the last 6 years FCF averaged ~$56M/year and they paid out ~$51M on net to shareholders over that time period. To be conservative I wouldn’t expect more than $45M per year on net moving forward. Even still that’s a ~9.1% net shareholder yield as compared to Haverty’s enterprise value. It should go without saying, that’s quite tasty!

8. How does the company stack up against their peers?

Ethan Allan Interiors Inc. $ETD is the closest competitor to $HVT:

$ETD EV/Sales: 0.82

EV/EBIT: 4.85

Price/Book: 1.74

Both of these companies look like a carbon copy of each other from a fundamental standpoint. If you put a gun to my head I would prefer $HVT as topline growth has been slightly better and they have a smaller store count to expand. Nonetheless, there’s no clear winner here and I don’t have a strong opinion either way.

9. What’s the counter argument?

The counter argument is that sales and profits are at their peak and will sharply mean revert in coming quarters.

There’s very little doubt in my mind that this will happen. Demand is objectively slowing and the housing market looks awful. The question is what will margins look like in a year or so? Candidly I have no idea, but even if operating profit mean reverted back to 2020 levels, the business would still be trading at ~12.5X EV/EBIT, which is objectively not expensive for a growing company. For these reasons I think most of the bear arguments are already priced into the stock.

10. Is there something I think the market may be missing?

The housing market is starting to take a beating with 30-year mortgages now over 7%. It doesn’t take a genius to figure out that this is bad news for furniture companies. However $HVT is regionally focused in the south eastern US. I wouldn’t be surprised to see real estate hold up well in this region as it’s much cheaper to live in Florida or Texas compared to a New York or California. If this thesis pans out $HVT will likely see far less of a pullback in earnings than Mr. Market is currently anticipating.

Final Thoughts:

My base case would be revenues dropping to $900M in 2023, then growing by 6% per year thereafter. I would also expect an EBIT margin of 5.5% 5 years from now and a 9% shareholder yield annually with a 12X EV/EBIT exit multiple. That works out to a ~17.5% IRR, which is impressive. Unfortunately, I don’t have a lot of confidence in this forecast as the business is extremely cyclical. Additionally the company isn’t trading at a massive discount to book value. For example $HVT was trading at 0.8X book at the March 2020 lows. For this reason I don’t think now is the time to buy a furniture company, but definitely worth tracking as there’s almost no chance $HVT goes to zero.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice