*** Disclosure: $HBI makes up ~ 2.7% of my P.A. so what you’re about to read is heavily biased***

1. Is the company undervalued?

EV/EBIT: 9.45

Price/Sales: 0.81

Price/Book: 7.6

$HBI is a quality business which trades at a large discount to the market. While growth has historically been modest, the business is incredibly durable and fairly easy to predict. This coupled with a generous shareholder yield makes Hanesbrands an intriguing risk adjusted bet.

2. Can I easily explain what the company does?

Yes, they manufacture underwear and activewear apparel. Their most notable brands are Hanes and Champion.

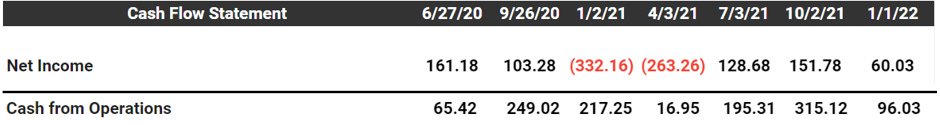

3. Does the cash flow statement line up with income statement?

Yes, cashflows have been consistently higher than reported earnings:

Most of their excess cash went towards paying down debt, dividends paid out, and capital expenditures. The only cause for concern is a buildup of inventories, which has grown 16% YOY. Potentially signaling that management is too optimistic about future demand. However this is a pretty small nitpick and I don’t have any issues with these capital allocation decisions.

4. Is the Balance Sheet Healthy?

Total Debt: $3.74B

Total Cash: $536.28M

Current Ratio: 1.52

$HBI does hold a meaningful amount of debt relative to their market cap. Although management has done a good job of paying it down recently, extinguishing $668M last year alone. Furthermore $HBI has impressive cashflow metrics and are expected to pay $142M in net interest payments next year, which is down from $163M in 2021. Moreover management has signaled that they’re comfortable with the current 2.7X Debt to EBITA ratio and that metric should improve as earnings grow over time. All in all suboptimal numbers here, but certainly serviceable and not a serious concern for shareholders.

5. How profitable is the business?

Gross Margins: 39.1%

Operating Margins: 13.7%

Net Margins: 1.14%

Return on Assets: 7.9%

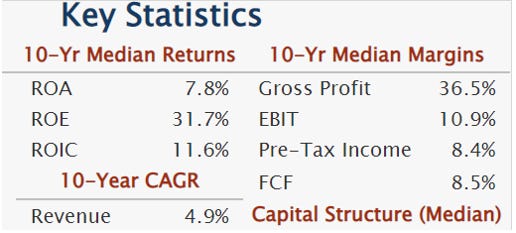

Some of the trailing data is wonky due to non-cash impairment and write down charges. With that said, the business has historically been quite profitable:

While these numbers aren’t gonna blow anyone away, $HBI has proven they have pricing power and a moat surrounding their brands. Moreover management has made a goal to achieve 14.4% operating margins by 2024. I don’t put much weight in 3-year forecasts, but this number doesn’t seem unreasonable given their starting point. It’s for these reasons that I believe $HBI is slightly above average business.

6. What is the company’s growth potential?

10-yr Revenue CAGR: 4.16%

10-yr Operating Profit CAGR: 7.76%

10-yr FCF CAGR: 0.77%

Hanesbrands is no doubt a slow grower, but that’s the nature of the industry they’re in and shareholders can still achieve satisfactory returns with low-mid single digit growth. Management is also forecasting 5.5% topline and 12.95% EBIT growth per year going out until 2024. I’m a bit skeptical that $HBI actually hits these targets, but it’s nice to see management focused on bottom line growth instead of growth at any cost.

7. Is management rewarding shareholders?

Hanesbrands currently yields a generous 3.89% dividend and just announced a 3-year share repurchase program for $600M. Management has also signaled that repurchases will begin immediately and be done every quarter. With that said I’m not sure $HBI can afford $200M in buybacks this year, as they’re ramping CAPEX significantly. However $HBI should have around $120M in cash after all expenses (assuming the low end of their earnings guidance). Moreover Hanesbrands believes they can hit $1.6B in free cashflow over the next three years, which is more than enough to repurchase all $600M in equity and satisfy the current dividend obligation. Put simply $HBI is offering investors a ~ 7.5% total shareholder yield over 3 years, which is phenomenal! Additionally this number could be lowballed as share repurchases will reduce the cash outlay for dividends moving forward and $HBI would have an additional $375M in cash if they hit their goal of $1.6B in free cash flow by 2024.

8. How does the company stack up against their peers?

There’s no publicly traded company that exclusively sells undergarments and activewear, for this reason I’m going to skip this question.

9. What’s the counter argument?

The bear argument is that $HBI faces inflationary headwinds in the near term and they won’t be able to pass on those costs to consumers. Moreover they operate in a competitive industry and are susceptible to disruption.

I’m rather dismissive of these arguments, management has already put in place two price increases for 2022 which should offset any inflationary input costs. Furthermore $HBI is an extremely durable brand and customers are willing to pay a premium for their product. So long as the price discrepancy isn’t egregious, there’s no need to take a flyer on some no name discount underwear brand. Finally Hanesbrands was able to pick up market share in 2021, so the competition concerns are largely overblown IMO.

10. Is there something I think the market may be missing?

Management has communicated that they’re making their core business leaner and meaner. They’ve done this by eliminating around 30% of SKUs and intend to reduce more in the future. This should improve operating efficiencies, which in turn should boost profitability.

Additionally Hanesbrands is selling off non-core subsidiaries. Most notably Sheer Hosiery, which is estimated to be worth $60M and was/is a break-even business. They also divested from their European innerwear business, which is expected to finalize next quarter and was a drag on the bottom line.

As if this wasn’t enough a director recently made an open market purchase:

There are many reasons to sell a stock, but pretty much only 1 reason to buy! For whatever reason Mr. Market seems to have a bearish interpretation of these tea leaves.

Final Thoughts:

As previously mentioned I own $HBI, buying the stock originally in the summer of 2020. However I think it may be worth adding to at current levels. My base case would be 6% EBIT growth annually, 7% total shareholder yield, and a 12X EV/EBIT exit multiple in 3 years. If that scenario plays out investors would realize a ~21.3% CAGR by the start of 2025. If you’re looking for an uncorrelated bond proxy $HBI is a no brainer (certainly more attractive than bonds).

Moreover $HBI offers a significant right tail payoff if management hits their 2024 targets (28.3% expected CAGR over 3 years) and the assumptions used here are fairly modest. While my ego wants me to buy compounders with a higher expected return, $HBI is a perfect example of a one-foot hurdle. Will the company ever be a 100 bagger? No, but the odds of it becoming a donut are next to zero. In closing I plan on accumulating shares as long as the stock remains undervalued and would even considering sizing it to a 10% position.

***Disclosure: The author is long the stock as of the time of this publishing. This article is intended for educational purposes only and in no way should be interpreted as investment advice.