1. Is the company undervalued?

EV/EBIT: 6.26

EV/Sales: 0.65

Price/Book: 1.51

$GPRO is cyclical stock, which is trading near all-time lows in regards to book value and sales. With that said there’s a strong case to be made that the business is headed for a material slow down and mean reversion in profitability. Nevertheless management believes they can continue to grow topline over the next 12 months. Furthermore $GPRO has a sterling balance sheet and are returning sizeable capital back to shareholders. If management is correct in their assertions, there’s a strong chance the stock is mispriced.

2. Can I easily explain what the company does?

Yes, they manufacture cameras and related accessories. They company also offers subscriptions and services on the hardware they sell.

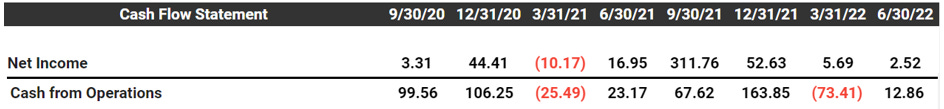

3. Does the cash flow statement line up with income statement?

No, cashflows have been slightly lower than reported earnings:

However when taking into account the increase of inventories, the numbers begin to make sense. Most of their excess cash went towards a build up of inventories, debt repayment, and share repurchases. Bloated inventories are always a cause for concern with discretionary stocks. However inventories are only up 18% YOY, which is relatively good compared to other cyclical stocks. Moreover management stated that inventories levels with their distributors are at a normal historical rate.

Other than that, I have no issues with GoPro’s capital allocation decisions.

4. Is the Balance Sheet Healthy?

Total Cash: $322.4M (this includes marketable securities)

Total Debt: $189.5M

Current Ratio: 2.19

With a net cash position, $GPRO gets awarded the coveted; Fortress Balance Sheet!!!

5. How profitable is the business?

Gross Margins: 41.3%

Operating Margins: 10.3%

Net Margins: 31.7% (this number is wonky)

On the surface $GPRO looks like a good business, however profitability has been all over the place:

As you can see it’s extremely difficult to forecast out a normalized profit margin for $GPRO. This is likely why Mr. Market is assigning $GPRO an extremely low multiple on their present earnings. Having said that, management does seem to be making a concerted effort to improve profitability:

6. What is the company’s growth potential?

10-yr Revenue CAGR: 17.4%

10-yr Operating Profit CAGR: 7.66%

9-yr FCF CAGR: 11.46%

They say numbers never lie, but in this case I would argue GoPro’s growth metrics are fibbing. For one the end date used here is a peak year of earnings. Moreover sales are down nearly 27.5% from 2015, which makes the “compounder” narrative a bit sus. In fairness $GPRO is launching a couple new products at the end of 2022 and they’ve only recently started offering subscriptions/services. Therefore I would be surprised if $GPRO turned into a melting ice cube, but I also wouldn’t be comfortable forecasting out any higher than mid-single digit growth moving forward.

7. Is management rewarding shareholders?

$GPRO doesn’t offer a dividend, but have $78M remaining on their $100M share repurchase program. Considering the low valuation and balance sheet strength, shareholders will likely get the full $78M over the next 3 quarters. Although on go forward basis, I would be far less optimistic. For example FCF has averaged ~$33M per year over the last 5 years. Additionally stock based compensation was ~$40M last year, so investors shouldn’t be expecting meaningful capital returned back to them long term.

8. How does the company stack up against their peers?

I couldn’t find a publicly traded pure play camera manufacturer, so I’m gonna skip this question.

9. What’s the counter argument?

The counter argument is virtually the same as every other discretionary stock; we’re headed for a global recession, consumers are getting squeezed by inflation, and everything is going to zero!!!

I was being a bit hyperbolic there, but I more of less agree with this thesis. Analysts are still forecasting higher sales and earnings next year for $GPRO. While I do think there’s a chance topline grows in 2023, I would be stunned if earnings grew. For instance EBIT margins were negative from 2016-2020, with a much rosier macroeconomic backdrop.

10. Is there something I think the market may be missing?

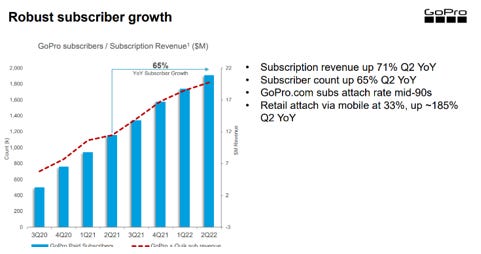

$GPRO has recently pivoted to more of a subscription-based model, which intuitively makes the company more appealing. Chiefly because subscription revenue is stickier and much higher margin. Furthermore it’s difficult to argue that this shift isn’t already creating shareholder value:

If this subscription model proves to be as effective as most software companies, than $GPRO is likely structurally way less cyclical than the historic data would suggest.

Final Thoughts:

$GPRO is almost an impossible stock to model out with any degree of certainty. I’m also not a camera guy and wouldn’t have the slightest clue regarding their competitive advantage in the marketplace. For those reasons it’s a pass, but something to monitor as the subscription model is interesting and Mr. Market might be slow to give $GPRO credit if the strategy proves effective.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice