1. Is the company cheap?

EV/EBIT: 24.29

Price/Sales: 6.85

Price/FCF: 18.42

$EA is by no means a cigar butt, the company is expensive based on any quantitative measure. Having said that Electronic Arts does have some very impressive profitability metrics and would fall into the “growth at a reasonable price” category IMO.

2. Can I easily explain what the company does?

Yes, they sell video games.

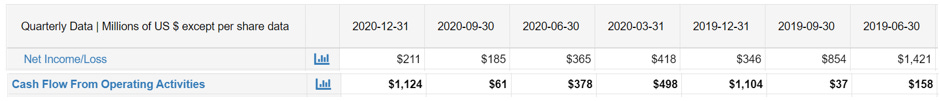

3. Does the cash flow statement line up with income statement?

For the most part yes:

Furthermore the company spent 28.16% its 2020 revenues on research and development. This is a strong message that management is focused on future growth.

4. Is the Balance Sheet Healthy?

Total Debt: $1.29B

Total Cash: $6.71B

Current Ratio: 2.21

$EA has an ELITE balance sheet! In fact, $EA’s enterprise value is lower than their market cap! A feat that not many publicly traded companies can claim. All in all, very high marks here.

5. How profitable is the business?

Gross Margins: 74.53%

Net Margins: 30.79%

ROE: 15.51%

Profitability is where $EA’s bread is buttered. These metrics are all well above the market averages, which is why Electronic arts trades at a premium to the market. Furthermore these profitability metrics have been persistent over time, which would indicate a very high quality business:

6. Is management rewarding shareholders?

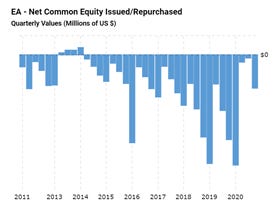

$EA made their first dividend distribution ever in December of 2020. While the yield is a paltry 0.52%, their payout ratio is only 4.19% so certainly room grow that dividend in the future. Additionally management has done nothing but buyback shares since 2014:

The total shareholder yield is actually quite impressive, given that management is still in growth mode. Today’s shareholders are getting a below average yield, but that could change in the future if $EA keeps executing.

7. How does the company stack up against their peers?

$EA’s biggest competitors are Activision Blizzard $ATVI and Take-Two Interactive $TTWO:

$ATVI Price/Sales: 8.71 $TTWO Price/Sales: 5.96

EV/EBIT: 24.07 $EV/EBIT: 32.64

Gross Margins: 72.05% Gross Margins: 49.87%

We can immediately eliminate $TTWO, as they’re the most expensive on an EV/EBIT basis and have the worst gross margins. $ATVI and $EA have very similar price ratios and there is no clear winner. I would be inclined to give the smallest edge to $EA however, as they have bought back shares while $ATVI has been a net issuer of shares.

8. What’s the counter argument?

The gaming industry experienced a boom in 2020, as people were forced to stay at home due to coronavirus. It will be very difficult to beat these comps in 2021 as a result. Additionally while $EA has been spending aggressively on R&D, they may be spreading themselves too thin. In football there’s a saying; “If you have two quarterbacks, then you have none”. Perhaps the same can be said about $EA’s future pipeline.

I have to admit upfront that I’m not a gamer, nor have I ever been one in my life. Having said that investors often times overweight qualitative reasons to buy a stock IE: “Their products are awesome and all my friends buy their stuff”. These reasons should be significantly underweighted unless you are an expert in that given industry (sorry to tell you, but you’re probably not). With that out of the way there’s no doubt 2021 comps will be tough, but increased spending on R&D does bode well for $EA. Moreover I have no idea what demand will look like for $EA’s future pipeline of games, therefore investors default position should be indifferent (neither bullish or bearish). No one knows the future so stop pretending like you do!

9. Is the company unsexy, uncool, or contrarian?

$EA has 8 analysts that cover the stock with; 1 sell, 6 neutral, and 1 outperform ratings out. I was actually surprised to see the lack of enthusiasm analysts had for the stock, as they experienced a major tailwind in 2020. Be that as is may I still wouldn’t consider $EA to be contrarian. Additionally the stock is certainly not unsexy or uncool. Gaming is a growing space and it’s a lot easier to sell someone on a growth story, as opposed to some boomer stock with a 3% dividend yield.

10. Is there something I think the market may be missing?

$EA’s share price has gone sideways for about 3 years now. I find that to be a bit odd, as the underlying business has grown significantly in the same time. This is most likely due to the share price getting ahead of its skis in 2018, trading at almost 10X sales. However, $EA is priced much more reasonably today. If $EA grows at the same rate or faster over the next 3 years, I would not be surprised if the stock doubles.

Final Thoughts:

$EA is very high-quality business. While the business is priced for growth ahead, I wouldn’t say it’s priced to perfection. Unfortunately I don’t think there’s a wide enough margin of safety to be a buyer at these levels. At my core I’m a traditional value investor and would rather not rely on growth to achieve a satisfactory investment return. Having said that $EA is worth tracking and if they trade at or below a market multiple, I would be quite interested.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interrupted as investment advice.