Carter’s Inc. $CRI

My Investment Checklist

1. Is the company undervalued?

EV/EBIT: 9.48

Price/Sales: 1.21

Price/Book: 3.77

$CRI trades at a borderline wonderful price, however the business is objectively below average. Notwithstanding Carter’s has serviceable profitability metrics and is guiding for double digit revenue growth next year. If management can delivery on these promises, the stock is severely undervalued at current levels.

2. Can I easily explain what the company does?

Yes, they sell baby clothing. Their two biggest brands are Carter’s and OshKosh B’Gosh.

3. Does the cash flow statement line up with income statement?

Yes, cashflows have been consistently higher than reported earnings:

Most of this free cash flow went towards paying down debt, capital expenditures, and dividends paid out. I have zero qualms with these capital allocation decisions.

4. Is the Balance Sheet Healthy?

Total Debt: $1.63B

Total Cash: $1.12B

Current Ratio: 3.14

$CRI holds very little debt relative to their market cap, while throwing off a silly amount of free cashflow. The balance sheet is by no means a concern for shareholders and I would give them an A-, falling just short of fortress balance sheet territory.

5. How profitable is the business?

Gross Margins: 47.52%

Net Margins: 9.89%

ROIC: 14.01%

10-yr Revenue CAGR: 5.6%

The trailing 12-month data is most likely overstating Carter’s normalized profitability metrics. Here’s what they’ve done over the last decade:

As you can see the numbers tapper off, but not by much. $CRI is below average in regards to profitability, averaging 7.33% net margins historically. However the current valuation would have you think it’s a low margin commodity business. For example Carter’s has historically traded in the 13-16X EV/EBIT multiple range. Intuitively this seems like a more fair representation of intrinsic value, as $CRI has respectable profit margins and solid growth prospects.

6. Is management rewarding shareholders?

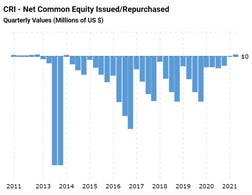

$CRI recently reinstated their dividend in April of 2021, which is yielding 1.7%. Furthermore the company has $650M authorized for share repurchases. Unfortunately management hasn’t done any buybacks year to date, but they have a history of doing so:

Given Carter’s balance sheet strength and free cash flow guide of $425M, I don’t think it would be unreasonable to expect a $200M returned back to shareholders over the next 12 months. This would equate to 4.71% total shareholder yield, which of course is exceptional!

7. How does the company stack up against their peers?

The closest competitor I could find for $CRI was Children’s’ Place Inc. $PLCE:

$PLCE Price/Sales: 0.7

EV/EBIT: 12.02

Gross Margins: 36.73%

$PLCE and $CRI trade at a similar valuation and both hold minimal debt. However Carter’s has better margins and has grown revenues over the last 10 years, whereas $PLCE’s revenues have been more or less flat. This coupled with zero shareholder yield from $PLCE, makes $CRI the no brainer choice.

8. What’s the counter argument?

The counter argument is that retail sales have hit a cyclical peak and revenues will begin to decline from here. Moreover $CRI is sure to face more competition and margins will begin eroding.

I’m actually inclined to buy into these bear arguments, as retail sales have been running hot for a year and there’s less government funny money to go around. Notwithstanding, I don’t think this will have a material impact on the business. Furthermore management upped their guidance meaningfully in the last quarter, which leads me to believe that demand will stay strong for at least a couple more quarters.

The competition argument I find to be the most compelling. Before this write up, I had zero knowledge of Carter’s. For this reason I’m inclined to believe that their moat is non-existent (please let me know if this isn’t the case). Moreover there’s virtually no barriers to entry in the baby clothing space, so it wouldn’t surprise me if $CRI posted 6% net margins in the next 10 years.

9. Is the company unsexy, uncool, or contrarian?

$CRI has 8 analysts covering the stock with; 6 holds, 1 outperform, and 1 buy rating out. Therefore the company certainly isn’t contrarian. Additionally I wouldn’t consider Carter’s to be unsexy or uncool as baby clothing is a sweet and innocent business.

10. Is there something I think the market may be missing?

As mentioned previously management is guiding for 15% sales growth and operating income of $475M. That would imply a forward EV/EBIT of 7.32, which is a banana land valuation for a company of this quality. If management can delivery, then $CRI could easily double by this time next year.

Final Thoughts:

Carter’s checks literally every single one of my investment boxes and appears to be woefully undervalued at current levels. Unfortunately I know nothing about the baby apparel industry and for that reason can’t assess the durability of $CRI’s business. If the stock price went against me, I would be worried about succumbing to behavioral biases. Therefore it’s a pass for me, but certainly a compelling opportunity for those with industry experience.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice