1. Is the company undervalued?

EV/Sales: 3.87

Price/Book: 1.1

Carnival is an absolute dumpster fire with the company incinerating cash every quarter for the past 10 quarters!!! As a result, $CCL was forced to take on a massive debt load while also issuing new shares. Notwithstanding cruise lines are an extremely durable industry with huge barriers to entry and $CCL very well could have their best sales year ever in 2023. If Carnival can finally start generating profit, investors may benefit by buying while there’s pools of blood in the street.

2. Can I easily explain what the company does?

Yes, they offer cruise line vacations globally and have 91 ships in operation.

3. Does the cash flow statement line up with income statement?

These numbers make me want throw up, but yes cash from operations has been less negative than reported earnings:

Most of the cash used went towards capital expenditures. $CCL also raised ~$4.5B of net debt and issued $1.2B in equity last year. Obviously these are suboptimal uses of capital, but were done out of necessity. CAPEX was also notably high compared to history, however with demand so low I thought it was logical to reinvest during this slow period.

4. Is the Balance Sheet Healthy?

Total Cash: $7.07B

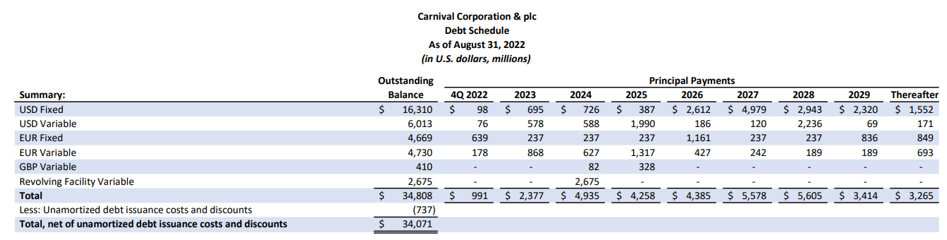

Total Debt: $35.29B

Current Ratio: 0.65

I’m stunned the woke mob hasn’t come after $CCL, because their balance sheet is problematic! For context long term debt was sitting at ~$7B in 2017 and has ballooned to over $28.5B in the most recent quarter!!! In fairness no one could’ve predicted the pandemic and what that would do to the cruise line industry. However management has been far too optimistic with their guidance regarding profitability and balance sheet health. For example it was communicated at the end of 21’ that $CCL wouldn’t have to issue shares or raise debt. They then proceeded to issue $1B in stock and $6B in debt with an absurd 12.5% coupon in July! The good news is that they’ve hired a new CEO and are communicating more transparently with solvency concerns:

Unfortunately the situation remains dire, but a step in the right direction nevertheless.

5. How profitable is the business?

Gross Margins: 25.5%

Operating Margins: (50.8)%

Net Margins: (74)%

Spooky season is officially here and I’m not talking about Halloween! Joking aside cruise lines have actually been historically quite profitable:

As you can see in a normal environment, $CCL is an above average business. The bad news is that Carnival still isn’t out to the woods and will likely burn thru more cash for at least another quarter. However the company does have a couple tailwinds behind them including; ships at ~90% capacity, their order backlog increasing, and lower expected CAPEX in 2023. For these reasons I don’t think it would be unreasonable to assume low double digit operating margins long term.

6. What is the company’s growth potential?

Measurements taken from 2010-2019:

10-yr Revenue CAGR: 3.71%

10-yr Operating Profit CAGR: 3.46

10-yr FCF CAGR: (15.9)%

The FCF metric is significantly understated due to 2019 being the highest CAPEX spend year in company history. Nevertheless $CCL grew sales pretty every year during the 10-year sample period. This was also done with virtually no acquisitions. Carnival is by no means a compounder, but low single digit growth is probably a solid base case once revenues fully normalize.

7. Is management rewarding shareholders?

Quite the opposite, management has been aggressively diluting shareholders since 2019. There’s also no capital return policy in place, which is prudent as $CCL is up to their eyeballs in debt. Candidly a win for shareholders would be zero dilution moving forward and a concerted effort to deleverage their balance sheet. We’ll see if that happens, but I would be surprised if $CCL in the short-term taps capital markets again.

8. How does the company stack up against their peers?

Royal Caribbean Cruises Ltd. $RCL is Carnival’s biggest competitor:

$RCL EV/Sales: 7.11

Gross Margins: (1)%

Price/Book: 3.4

Total Debt: $23.85B

First off, I’d like to say that a negative gross margin is one of the most impressive fails I’ve ever seen. I mean even by Keith Rabois standards the company is losing money! With that said $RCL is 3X more expensive relative to assets and face the same debt issues as $CCL. $RCL technically has a better balance sheet, but both are God awful. To me, $CCL seems like the obvious choice here.

9. What’s the counter argument?

The counter argument is that $CCL won’t be able to turn a profit with a difficult regulatory back drop and a seemingly ever-increasing debt burden.

This thesis does make a lot of sense to me. For example net interest payments are hovering around $1.6B annually. Additionally interest rates are going up across the board, while Carnival’s credit rating is deteriorating. For context $CCL only paid $206M in interest payments during 2019. In short there’s a very real chance $CCL turns into a doughnut.

10. Is there something I think the market may be missing?

Mr. Market is penalizing travel related stocks on fears of an impending/current recessionary environment. I actually don’t think a recession would be bad for cruise lines, chiefly because they could benefit from a trade down. It’s estimated that a cruise vacation is between 25-50% cheaper vs. a land-based equivalent. That seems like a huge delta, which probably shrinks over time. Moreover this opens up an opportunity to increase prices down the road, which hopefully leads to higher margins.

Final Thoughts:

Carnival is a terrifying stock to buy and no doubt a contrarian pick. However you don’t get paid simply by betting against the crowd. Furthermore the stock is barely trading at a discount from 2019. While the Market cap is down roughly 69% from 2019, the enterprise value is only down ~7.5%. There are plenty of stocks in this market down wayyy more than that with limited solvency concerns. For these reasons $CCL is pass, but something I wouldn’t write off totally as there’s potential if the business rebounds.

***Disclosure: I have no position in the security mentioned above, nor do I have any plans to purchase within the next 72 hours. This article is intended for educational purposes only and in no way should be interpreted as investment advice